IL IL-1040 Schedule ICR 2015 free printable template

Instructions and Help about IL IL-1040 Schedule ICR

How to edit IL IL-1040 Schedule ICR

How to fill out IL IL-1040 Schedule ICR

About IL IL-1040 Schedule ICR 2015 previous version

What is IL IL-1040 Schedule ICR?

Who needs the form?

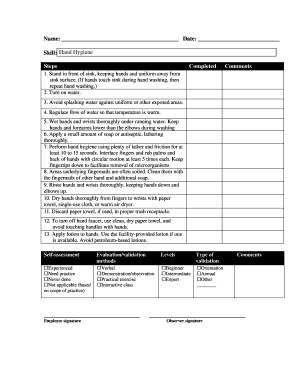

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IL IL-1040 Schedule ICR

What should I do if I realize I've made a mistake on my IL IL-1040 Schedule ICR after submission?

If you discover an error on your IL IL-1040 Schedule ICR after submission, it’s important to file an amended return as soon as possible. You can correct mistakes by completing the updated form and indicating that it's an amendment. Ensure to keep a copy of the original and the amended returns for your records.

How can I verify if my IL IL-1040 Schedule ICR has been processed?

To check the status of your IL IL-1040 Schedule ICR, visit the Illinois Department of Revenue website. They typically offer online tracking services where you can input your details to verify the receipt and processing of your form. Always allow a few weeks after submission before checking for updates.

What should I do if my e-filed IL IL-1040 Schedule ICR is rejected?

If your e-filed IL IL-1040 Schedule ICR is rejected, review the error codes provided in the rejection notice carefully. Common issues may include missing information or formatting errors. Correct these issues and resubmit your form promptly to ensure compliance and avoid penalties.

Are there any specific privacy or data security considerations when filing the IL IL-1040 Schedule ICR?

When filing the IL IL-1040 Schedule ICR, it's crucial to ensure that your personal information is protected. Use secure networks and reputable e-filing software that comply with data security standards. Be cautious of phishing attempts and ensure you review your submissions for accuracy to safeguard your privacy.